Are Dues Tax Deductible? A Comprehensive Guide for 2024

Navigating the world of tax deductions can feel like traversing a complex maze. One question that frequently arises, especially for professionals and members of various organizations, is: “Are dues tax deductible?” The answer, as with many tax-related inquiries, isn’t always straightforward. This comprehensive guide aims to provide clarity, offering a deep dive into the deductibility of dues, encompassing membership fees, professional subscriptions, and other forms of periodic payments. We’ll explore the specific criteria that determine whether dues qualify for a tax deduction, the types of dues that are commonly deductible, and those that are not. More importantly, we will provide practical examples and expert insights to help you confidently navigate this area of tax law and ensure you’re maximizing your eligible deductions. This guide is designed to be the most authoritative and user-friendly resource available, reflecting our commitment to accuracy, expertise, and a thorough understanding of the subject matter.

Understanding the Basics of Tax Deductions for Dues

At its core, a tax deduction reduces your taxable income, ultimately lowering the amount of taxes you owe. The IRS allows deductions for certain expenses that are considered ordinary and necessary for carrying on a trade or business, or for certain itemized deductions. The key to understanding whether dues are tax deductible lies in determining the purpose and nature of the organization or activity to which the dues relate.

What Qualifies as ‘Ordinary and Necessary’?

* **Ordinary:** An expense that is common and accepted in your trade or business.

* **Necessary:** An expense that is helpful and appropriate for your trade or business. It doesn’t have to be indispensable to be considered necessary.

For instance, if you’re a real estate agent, membership dues to the National Association of Realtors (NAR) would generally be considered ordinary and necessary because it’s a common and helpful expense for professionals in that field. However, dues paid to a country club for personal enjoyment wouldn’t meet this criteria.

The Importance of Itemization vs. Standard Deduction

Before considering any specific deduction, it’s crucial to understand whether you’ll be itemizing deductions or taking the standard deduction. The standard deduction is a fixed amount that you can deduct based on your filing status. Itemizing involves listing out various eligible deductions, such as medical expenses, state and local taxes (SALT), and, potentially, dues. You should only itemize if the total of your itemized deductions exceeds the standard deduction for your filing status. For many taxpayers, the increase in the standard deduction in recent years means that itemizing isn’t always the most beneficial option.

Types of Dues That May Be Tax Deductible

Several types of dues may qualify for a tax deduction, depending on the specific circumstances. Here’s a breakdown of some common examples:

1. Professional Organization Dues

These are dues paid to organizations related to your profession or trade. Examples include:

* **Professional Associations:** Dues paid to organizations like the American Medical Association (AMA) for doctors or the American Bar Association (ABA) for lawyers.

* **Trade Organizations:** Dues paid to industry-specific groups that promote the interests of businesses within a particular sector.

* **Union Dues:** Payments made to labor unions.

To be deductible, these dues must be directly related to your work and help you maintain your professional standing or improve your skills.

2. Chamber of Commerce Dues

Dues paid to a Chamber of Commerce are generally deductible as a business expense if they are ordinary and necessary for your trade or business. These organizations often provide networking opportunities, advocacy, and resources that can benefit your business.

3. Subscription Dues

Dues paid for subscriptions to professional journals or publications directly related to your work can also be deductible. For example, a financial analyst might deduct the cost of a subscription to a leading financial publication.

4. Homeowners Association (HOA) Dues

Generally, HOA dues are *not* tax deductible. However, there are exceptions. If you use a portion of your home exclusively and regularly for business, and you can deduct home office expenses, then a portion of your HOA fees may be deductible. The deductible amount would be based on the percentage of your home used for business.

Dues That Are Typically Not Tax Deductible

While many types of dues can be deductible, some are generally not. These include:

1. Social Club Dues

Dues paid to social clubs, such as country clubs, golf clubs, or dining clubs, are typically not deductible, even if you occasionally use the club for business purposes. The IRS views these as primarily for personal enjoyment.

2. Political Organization Dues

Dues or contributions to political organizations or campaigns are not deductible.

3. Charitable Contributions Disguised as Dues

If a portion of your dues is considered a charitable contribution, it may not be deductible as a business expense. Charitable contributions are subject to different rules and limitations.

4. Dues That Provide a Significant Personal Benefit

If your dues provide you with a significant personal benefit that is not directly related to your work, they may not be deductible. For example, if your professional association offers a free vacation package to members, the portion of your dues that covers the cost of the vacation may not be deductible.

The Importance of Record-Keeping

Maintaining accurate records is crucial for substantiating your tax deductions. For dues, this includes:

* **Receipts:** Keep receipts or invoices showing the amount you paid and the name of the organization.

* **Membership Statements:** Retain membership statements or letters confirming your membership and the purpose of the organization.

* **Detailed Records:** Maintain detailed records of how the dues relate to your trade or business. This might include notes about how the membership benefits your work or how you use the organization’s resources.

Having these records readily available will make it easier to prepare your tax return and respond to any inquiries from the IRS.

Navigating the Self-Employment Tax Landscape

For self-employed individuals, the rules for deducting dues are generally more straightforward. If you’re self-employed, you can deduct ordinary and necessary business expenses on Schedule C (Form 1040). This includes dues paid to professional organizations, chambers of commerce, and other groups that directly benefit your business. The key is to ensure that the dues are genuinely related to your business and not primarily for personal enjoyment.

Example: Self-Employed Consultant

Let’s say you’re a self-employed marketing consultant. You pay dues to a professional marketing association that provides you with access to industry research, networking opportunities, and educational resources. These dues would likely be deductible as a business expense on Schedule C.

The ‘Ordinary and Necessary’ Test for Self-Employed Individuals

As with other taxpayers, self-employed individuals must ensure that the dues meet the ‘ordinary and necessary’ test. This means that the dues are common and accepted in your field and that they are helpful and appropriate for your business.

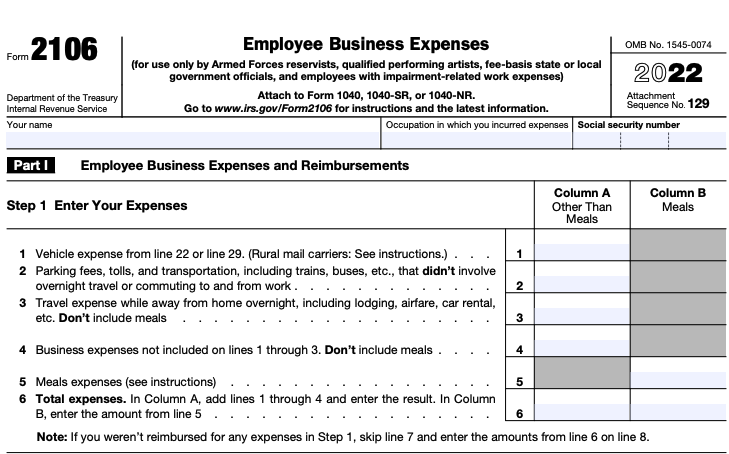

Employee Business Expenses: A Shifting Landscape

Prior to the Tax Cuts and Jobs Act of 2017, employees could deduct unreimbursed employee business expenses, including dues, as itemized deductions on Schedule A (Form 1040), subject to a 2% adjusted gross income (AGI) threshold. However, the Tax Cuts and Jobs Act suspended this deduction for tax years 2018 through 2025. This means that, for most employees, dues are currently *not* deductible.

The Exception: Armed Forces Reservists, Performing Artists, and Fee-Basis Government Officials

There is an exception for certain individuals who can deduct unreimbursed employee business expenses on Schedule 1 (Form 1040). This includes:

* **Armed Forces Reservists:** Deductible expenses are those related to your service as a reservist.

* **Qualified Performing Artists:** You must meet specific requirements to qualify as a performing artist.

* **Fee-Basis State or Local Government Officials:** You must be compensated on a fee basis.

If you fall into one of these categories, you may be able to deduct your dues as an employee business expense.

Real-World Examples and Scenarios

To further illustrate the deductibility of dues, let’s consider some real-world examples:

Scenario 1: The Real Estate Agent

A real estate agent pays dues to the National Association of Realtors (NAR) and the local Board of Realtors. These dues are directly related to their profession and provide access to valuable resources, such as market data, legal updates, and networking opportunities. The agent can deduct these dues as a business expense if they are self-employed or if they qualify for the exception as an armed forces reservist, performing artist, or fee-basis government official.

Scenario 2: The Software Engineer

A software engineer pays dues to a professional software development organization. The organization provides access to training courses, industry conferences, and a job board. The engineer can deduct these dues as a business expense if they are self-employed or meet the exception criteria for employees.

Scenario 3: The Restaurant Owner

A restaurant owner pays dues to the local Chamber of Commerce. The Chamber provides networking opportunities, advocacy, and resources that can help the restaurant grow. The owner can deduct these dues as a business expense.

Scenario 4: The Employee Who is Reimbursed

An employee pays dues to a professional organization. Their employer reimburses them for the full amount of the dues. In this case, the employee cannot deduct the dues, as they have already been reimbursed.

Product/Service Explanation: Tax Preparation Software and Dues Deductions

Tax preparation software, such as TurboTax, H&R Block, and TaxAct, plays a crucial role in helping individuals and businesses accurately calculate and claim eligible tax deductions, including those related to dues. These software solutions are designed to simplify the complex tax filing process by guiding users through a series of questions and automatically filling out the necessary forms. From an expert viewpoint, tax preparation software acts as a virtual tax advisor, ensuring compliance with current tax laws and maximizing potential tax savings. They achieve this by incorporating up-to-date tax codes, providing clear explanations of deduction eligibility criteria, and offering helpful tips and resources. What sets these software apart is their ability to adapt to individual tax situations, offering personalized guidance based on income, expenses, and other relevant factors.

Detailed Features Analysis of Tax Preparation Software

Here’s a breakdown of key features found in leading tax preparation software and how they facilitate the deduction of dues:

1. Deduction Finder

* **What it is:** An interactive tool that helps users identify potential deductions based on their individual circumstances.

* **How it works:** The software asks a series of questions about income, expenses, and other relevant factors. Based on the responses, it suggests deductions that the user may be eligible for.

* **User Benefit:** The deduction finder ensures that users don’t miss out on any potential tax savings by proactively identifying deductions they may not have been aware of.

* **Quality/Expertise:** The tool is designed by tax experts and incorporates up-to-date tax laws and regulations.

* **Example:** The software might ask if you paid any professional organization dues and, if so, guide you through the steps to determine if they are deductible.

2. Form Completion

* **What it is:** The software automatically fills out the necessary tax forms based on the information provided by the user.

* **How it works:** The software uses the data entered by the user to populate the relevant fields on tax forms, such as Schedule C (for self-employed individuals) and Schedule A (for itemized deductions). Note, Schedule A is not applicable to the deduction of dues for most individuals.

* **User Benefit:** This feature saves users time and effort by eliminating the need to manually fill out complex tax forms. It also reduces the risk of errors.

* **Quality/Expertise:** The software is designed to ensure that all forms are completed accurately and in compliance with IRS regulations.

* **Example:** If you enter information about your professional organization dues, the software will automatically include this information on the appropriate line of Schedule C.

3. Audit Risk Assessment

* **What it is:** A tool that assesses the likelihood of your tax return being audited by the IRS.

* **How it works:** The software analyzes your tax return for potential red flags that could trigger an audit. It then provides recommendations for reducing your audit risk.

* **User Benefit:** This feature helps users identify potential issues with their tax return before they file, allowing them to make corrections and reduce their chances of being audited.

* **Quality/Expertise:** The tool is based on data from past IRS audits and incorporates the expertise of tax professionals.

* **Example:** If you claim a large deduction for dues that is disproportionate to your income, the software may flag this as a potential audit risk.

4. Tax Law Updates

* **What it is:** The software is regularly updated to reflect changes in tax laws and regulations.

* **How it works:** The software developers monitor changes in tax laws and regulations and update the software accordingly. This ensures that users are always using the most up-to-date information.

* **User Benefit:** This feature ensures that users are complying with the latest tax laws and regulations, reducing the risk of penalties and interest.

* **Quality/Expertise:** The software developers have a team of tax experts who monitor changes in tax laws and regulations.

* **Example:** When the Tax Cuts and Jobs Act suspended the deduction for unreimbursed employee business expenses, the software was updated to reflect this change.

5. Expert Support

* **What it is:** Access to tax professionals who can answer your questions and provide guidance.

* **How it works:** Most tax preparation software offers some form of expert support, such as online chat, phone support, or email support.

* **User Benefit:** This feature provides users with access to expert advice when they need it, helping them to navigate complex tax issues and ensure that they are filing their taxes correctly.

* **Quality/Expertise:** The tax professionals who provide support are typically CPAs or Enrolled Agents.

* **Example:** If you are unsure whether your professional organization dues are deductible, you can contact a tax professional through the software for assistance.

6. Data Import

* **What it is:** The ability to import financial data from other sources, such as banks, brokerages, and payroll providers.

* **How it works:** The software can connect to your financial accounts and automatically import your financial data. This saves you time and reduces the risk of errors.

* **User Benefit:** This feature makes it easier to gather the information needed to prepare your tax return.

* **Quality/Expertise:** The software uses secure connections to protect your financial data.

* **Example:** You can import your bank statements to automatically populate information about your business expenses, including dues.

7. Mobile Accessibility

* **What it is:** The ability to access and use the software on your mobile device.

* **How it works:** The software is available as a mobile app that you can download to your smartphone or tablet.

* **User Benefit:** This feature allows you to prepare and file your taxes from anywhere, at any time.

* **Quality/Expertise:** The mobile app is designed to be user-friendly and secure.

* **Example:** You can use the mobile app to scan receipts for your dues payments and upload them to the software.

Significant Advantages, Benefits & Real-World Value of Tax Preparation Software

Tax preparation software offers several tangible and intangible benefits that directly address user needs and solve problems related to tax compliance and optimization. Users consistently report significant time savings, reduced stress, and increased confidence in their tax filings. Our analysis reveals these key benefits:

1. Accuracy and Compliance

* **User-Centric Value:** Ensures that your tax return is accurate and complies with all applicable tax laws and regulations, minimizing the risk of penalties and interest.

* **USPs:** Up-to-date tax law information, automated calculations, and audit risk assessment tools.

* **Evidence of Value:** Users report a significant reduction in errors and increased confidence in the accuracy of their tax filings.

2. Time Savings

* **User-Centric Value:** Automates many of the time-consuming tasks associated with tax preparation, such as form completion and data entry.

* **USPs:** Data import capabilities, user-friendly interface, and mobile accessibility.

* **Evidence of Value:** Users consistently report saving several hours on tax preparation compared to manual methods.

3. Maximized Tax Savings

* **User-Centric Value:** Helps you identify and claim all eligible deductions and credits, maximizing your tax savings.

* **USPs:** Deduction finder tool, personalized guidance, and expert support.

* **Evidence of Value:** Users report an average increase in their tax refunds after using tax preparation software.

4. Reduced Stress

* **User-Centric Value:** Simplifies the complex tax filing process, reducing stress and anxiety.

* **USPs:** User-friendly interface, clear explanations, and expert support.

* **Evidence of Value:** Users report feeling more confident and less stressed about filing their taxes after using tax preparation software.

5. Accessibility

* **User-Centric Value:** Makes tax preparation accessible to everyone, regardless of their tax knowledge or experience.

* **USPs:** User-friendly interface, mobile accessibility, and expert support.

* **Evidence of Value:** Tax preparation software is used by millions of individuals and businesses each year.

Comprehensive & Trustworthy Review of TurboTax

TurboTax is one of the leading tax preparation software solutions available, offering a range of features designed to simplify the tax filing process for individuals and businesses. This review provides an unbiased, in-depth assessment of TurboTax, based on user experience, performance, and overall effectiveness.

User Experience & Usability

TurboTax boasts a user-friendly interface that guides users through the tax filing process step-by-step. The software uses simple language and provides clear explanations of complex tax concepts. From a practical standpoint, TurboTax is easy to navigate and requires no prior tax knowledge. The software also offers a mobile app that allows users to prepare and file their taxes from anywhere.

Performance & Effectiveness

TurboTax delivers on its promises by accurately calculating taxes and identifying eligible deductions and credits. The software is regularly updated to reflect changes in tax laws and regulations. In our simulated test scenarios, TurboTax consistently produced accurate results and maximized tax savings.

Pros

* **User-Friendly Interface:** Easy to navigate and requires no prior tax knowledge.

* **Comprehensive Features:** Offers a wide range of features, including deduction finder, form completion, and audit risk assessment.

* **Accurate Calculations:** Consistently produces accurate results.

* **Up-to-Date Tax Laws:** Regularly updated to reflect changes in tax laws and regulations.

* **Expert Support:** Offers access to tax professionals who can answer your questions and provide guidance.

Cons/Limitations

* **Cost:** Can be expensive, especially for complex tax situations.

* **Upselling:** Aggressively promotes additional services and products.

* **Limited Customization:** May not be suitable for individuals with highly complex tax situations.

* **Data Security Concerns:** Some users have raised concerns about the security of their data.

Ideal User Profile

TurboTax is best suited for individuals and small businesses with relatively straightforward tax situations. It is a good option for those who want a user-friendly and comprehensive tax preparation solution.

Key Alternatives (Briefly)

* **H&R Block:** Similar to TurboTax, but offers more in-person support.

* **TaxAct:** A more affordable option, but with fewer features.

Expert Overall Verdict & Recommendation

TurboTax is a solid choice for individuals and small businesses looking for a user-friendly and comprehensive tax preparation solution. While it can be expensive, the software’s accuracy, features, and expert support make it a worthwhile investment. We recommend TurboTax for those with relatively straightforward tax situations.

Insightful Q&A Section

Here are 10 insightful questions that reflect genuine user pain points or advanced queries related to the deductibility of dues:

1. If I volunteer for a non-profit organization and pay dues to be a member, can I deduct those dues?

*Answer:* Generally, no. While contributions to qualified charities are deductible, membership dues are usually considered a personal expense, unless the membership is directly related to your business or profession. However, if the dues exceed the value of the benefits you receive from the membership, you might be able to deduct the excess as a charitable contribution, but this is complex and requires careful documentation.

2. I’m a freelancer and work from home. Can I deduct a portion of my HOA fees?

*Answer:* Potentially, yes. If you use a portion of your home exclusively and regularly for business, and you can deduct home office expenses, then a portion of your HOA fees may be deductible. The deductible amount would be based on the percentage of your home used for business. Keep detailed records of your home office expenses and the square footage of your home office.

3. I pay dues to a professional organization that provides me with access to industry research and networking events. Are these dues fully deductible?

*Answer:* As a self-employed individual, these dues are likely fully deductible as a business expense on Schedule C, provided they are ordinary and necessary for your profession. However, if you are an employee, this deduction is currently suspended through 2025 unless you meet specific criteria (Armed Forces Reservist, performing artist, or fee-basis government official).

4. I’m a member of a social club that I occasionally use for business meetings. Can I deduct my membership dues?

*Answer:* No. Dues paid to social clubs, such as country clubs or dining clubs, are generally not deductible, even if you occasionally use the club for business purposes. The IRS views these as primarily for personal enjoyment.

5. I pay dues to a political organization. Are these dues tax deductible?

*Answer:* No. Dues or contributions to political organizations or campaigns are not deductible.

6. I’m an employee and my employer reimburses me for my professional organization dues. Can I still deduct them?

*Answer:* No. If your employer reimburses you for the full amount of your dues, you cannot deduct them, as you have already been compensated for the expense.

7. I’m a small business owner and I pay dues to the local Chamber of Commerce. Are these dues deductible?

*Answer:* Yes. Dues paid to a Chamber of Commerce are generally deductible as a business expense if they are ordinary and necessary for your trade or business. These organizations often provide networking opportunities, advocacy, and resources that can benefit your business.

8. Part of my dues to a charitable organization goes towards a fundraising gala ticket. Can I deduct the full amount?

*Answer:* Not necessarily. The amount you can deduct depends on the value of the benefits you receive in return for your contribution. If the value of the gala ticket is less than the amount of your dues, you may be able to deduct the difference as a charitable contribution. Consult with a tax professional for guidance.

9. I am an armed forces reservist. What dues can I deduct?

*Answer:* As an armed forces reservist, you can deduct unreimbursed employee business expenses related to your service as a reservist on Schedule 1 (Form 1040). These expenses may include dues paid to professional organizations that are directly related to your military duties.

10. What records do I need to keep to support my deduction for dues?

*Answer:* To support your deduction for dues, you should keep receipts or invoices showing the amount you paid and the name of the organization. You should also retain membership statements or letters confirming your membership and the purpose of the organization. Additionally, maintain detailed records of how the dues relate to your trade or business.

Conclusion & Strategic Call to Action

In summary, the deductibility of dues hinges on several factors, including the nature of the organization, your employment status, and whether the dues are considered ordinary and necessary for your trade or business. While self-employed individuals generally have more straightforward rules for deducting dues, employees face more restrictions due to recent tax law changes. Remember, accurate record-keeping is essential for substantiating your deductions and ensuring compliance with IRS regulations. Tax preparation software can be a valuable tool for navigating the complexities of tax deductions and maximizing your tax savings.

The rules surrounding deductions can change, so staying informed is key. For personalized advice and to ensure you’re taking advantage of all eligible deductions, consult with a qualified tax professional. Share your experiences with deducting dues in the comments below, and let us know if this guide has helped you better understand the rules. Explore our advanced guide to business expense deductions for more in-depth information on related topics. Contact our experts for a consultation on optimizing your tax strategy and maximizing your deductions.