Russian Economic Performance: A Comprehensive Analysis

Understanding **russian economic performance** is crucial for investors, policymakers, and anyone seeking insights into the global economy. This article provides an in-depth analysis of Russia’s economic landscape, covering its historical trajectory, current state, key drivers, challenges, and future prospects. We aim to offer a comprehensive and trustworthy resource, drawing on expert knowledge and insights to deliver a clear and nuanced understanding of this complex topic.

This exploration goes beyond basic statistics, delving into the underlying factors shaping Russia’s economy and offering practical insights into its strengths and weaknesses. Whether you’re seeking to understand the impact of sanctions, the role of natural resources, or the country’s overall economic resilience, this guide will provide the knowledge you need.

Deep Dive into Russian Economic Performance

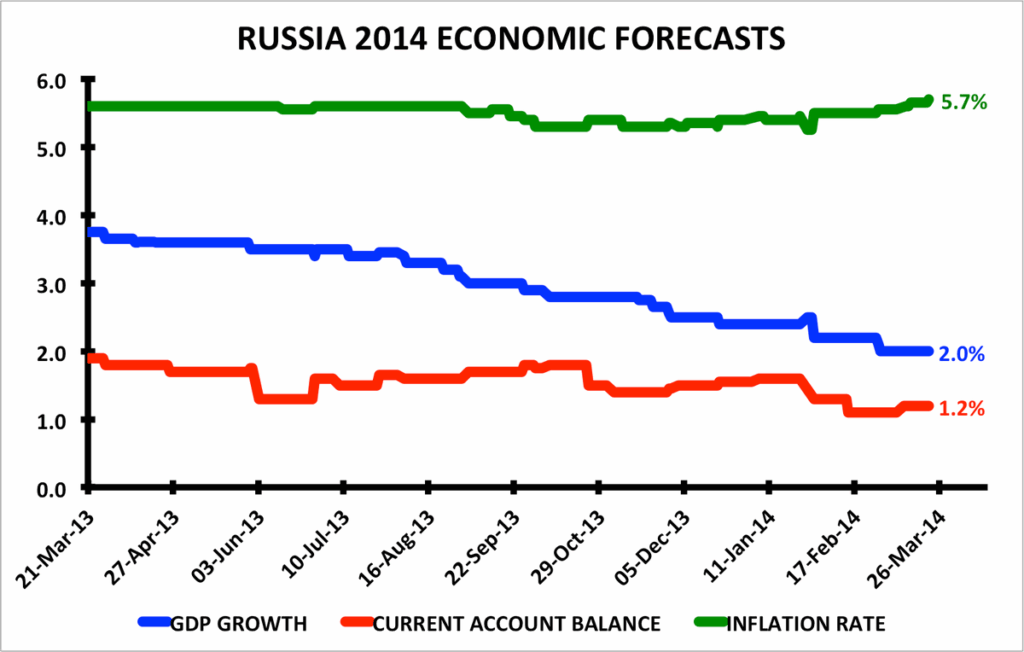

Russian economic performance is a multifaceted concept reflecting the overall health and productivity of Russia’s economy. It encompasses various indicators, including GDP growth, inflation rates, unemployment levels, trade balances, and foreign investment flows. However, understanding Russian economic performance requires going beyond these surface-level metrics.

Historically, Russia’s economy has been heavily influenced by its vast natural resources, particularly oil and gas. The transition from a centrally planned Soviet economy to a market-based system in the 1990s was turbulent, marked by hyperinflation, economic contraction, and widespread privatization. The early 2000s saw a period of strong growth driven by rising oil prices and economic reforms. However, this growth model has proven vulnerable to fluctuations in global commodity markets and geopolitical events.

**Core Concepts & Advanced Principles:**

* **GDP (Gross Domestic Product):** The total value of goods and services produced within Russia’s borders. GDP growth is a key indicator of economic expansion.

* **Inflation:** The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Russia has historically struggled with high inflation.

* **Unemployment:** The percentage of the labor force that is without work but actively seeking employment. Low unemployment is generally a sign of a healthy economy.

* **Trade Balance:** The difference between a country’s exports and imports. A positive trade balance (surplus) indicates that a country is exporting more than it is importing.

* **Foreign Direct Investment (FDI):** Investments made by foreign companies in Russia, such as building factories or acquiring businesses. FDI can boost economic growth and create jobs.

* **Sanctions:** Economic penalties imposed by other countries on Russia, typically in response to political or military actions. Sanctions can significantly impact Russia’s economic performance by restricting trade, investment, and access to financial markets.

Understanding the interplay between these concepts is critical for assessing **russian economic performance**. For example, high oil prices can boost GDP growth and improve the trade balance but can also lead to inflation and a dependence on a single sector.

**Importance & Current Relevance:**

Russian economic performance is of paramount importance for several reasons. First, Russia is a major global energy supplier, and its economic stability directly impacts global energy markets. Second, Russia’s economy is closely linked to those of its neighboring countries, particularly in Central Asia and Eastern Europe. Economic problems in Russia can spill over into these regions.

Furthermore, Russia’s economic performance has significant geopolitical implications. A strong economy allows Russia to project its influence on the world stage and pursue its strategic interests. Conversely, economic weakness can constrain its ability to do so.

Recent trends indicate that Russia’s economy is facing significant challenges due to Western sanctions imposed in response to the conflict in Ukraine. These sanctions have restricted access to technology, finance, and markets, leading to a decline in economic activity and a rise in inflation. Despite these challenges, the Russian economy has demonstrated some resilience, supported by high energy prices and import substitution efforts. However, the long-term impact of sanctions remains uncertain.

The Role of Central Bank of Russia (CBR)

The Central Bank of Russia (CBR) plays a crucial role in shaping **russian economic performance**. As the country’s central bank, the CBR is responsible for maintaining price stability, regulating the banking system, and managing the country’s foreign exchange reserves. The CBR’s monetary policy decisions, such as setting interest rates, have a significant impact on inflation, economic growth, and the exchange rate.

**Expert Explanation:** The CBR’s primary objective is to maintain price stability, which it achieves by targeting an inflation rate of 4%. To achieve this target, the CBR uses various tools, including setting the key interest rate, conducting open market operations, and managing reserve requirements for banks. The CBR also plays a crucial role in ensuring the stability of the banking system by supervising banks, providing liquidity support, and resolving failing banks.

What sets the CBR apart is its independence from the government. This independence allows the CBR to make monetary policy decisions based on economic considerations rather than political pressures. However, the CBR’s independence has been challenged in recent years, with some government officials calling for greater control over monetary policy.

Detailed Features Analysis of the CBR’s Monetary Policy

The CBR’s monetary policy is a complex and multifaceted tool that influences **russian economic performance** through various channels. Here’s a breakdown of key features:

* **Key Interest Rate:** The CBR’s main policy tool is the key interest rate, which is the rate at which it lends money to commercial banks. Changes in the key interest rate affect borrowing costs for businesses and consumers, influencing investment and spending decisions.

* *Explanation:* The CBR uses the key interest rate to control inflation. When inflation is above the target, the CBR raises the key interest rate to cool down the economy. Conversely, when inflation is below the target, the CBR lowers the key interest rate to stimulate economic activity.

* *User Benefit:* By maintaining price stability, the CBR helps to protect the purchasing power of consumers and businesses, creating a more predictable economic environment.

* *Demonstrates Quality:* The CBR’s commitment to price stability demonstrates its dedication to sound economic management.

* **Open Market Operations:** The CBR conducts open market operations by buying and selling government securities in the open market. These operations affect the money supply and interest rates.

* *Explanation:* When the CBR buys government securities, it injects money into the economy, increasing the money supply and lowering interest rates. Conversely, when the CBR sells government securities, it withdraws money from the economy, decreasing the money supply and raising interest rates.

* *User Benefit:* Open market operations allow the CBR to fine-tune monetary policy and respond to changing economic conditions.

* *Demonstrates Quality:* The CBR’s use of open market operations demonstrates its ability to manage liquidity in the banking system effectively.

* **Reserve Requirements:** The CBR sets reserve requirements for commercial banks, which are the percentage of deposits that banks must hold in reserve. Changes in reserve requirements affect the amount of money that banks can lend.

* *Explanation:* When the CBR lowers reserve requirements, banks have more money to lend, which can stimulate economic growth. Conversely, when the CBR raises reserve requirements, banks have less money to lend, which can cool down the economy.

* *User Benefit:* Reserve requirements help the CBR to manage credit growth and prevent excessive lending.

* *Demonstrates Quality:* The CBR’s use of reserve requirements demonstrates its ability to control credit conditions in the economy.

* **Foreign Exchange Interventions:** The CBR can intervene in the foreign exchange market by buying or selling rubles. These interventions affect the exchange rate.

* *Explanation:* When the CBR buys rubles, it strengthens the ruble’s exchange rate. Conversely, when the CBR sells rubles, it weakens the ruble’s exchange rate.

* *User Benefit:* Foreign exchange interventions can help to stabilize the ruble’s exchange rate and prevent excessive volatility.

* *Demonstrates Quality:* The CBR’s ability to manage the exchange rate demonstrates its competence in managing the country’s foreign exchange reserves.

* **Forward Guidance:** The CBR provides forward guidance by communicating its intentions regarding future monetary policy decisions. This helps to manage expectations and reduce uncertainty.

* *Explanation:* By providing forward guidance, the CBR can influence market expectations about future interest rates and inflation.

* *User Benefit:* Forward guidance helps businesses and consumers to make informed decisions about investment and spending.

* *Demonstrates Quality:* The CBR’s use of forward guidance demonstrates its commitment to transparency and communication.

* **Stress Tests:** The CBR conducts stress tests on banks to assess their resilience to adverse economic shocks. These tests help to identify potential vulnerabilities in the banking system.

* *Explanation:* Stress tests simulate the impact of various economic scenarios on banks’ balance sheets.

* *User Benefit:* Stress tests help to ensure the stability of the banking system and protect depositors’ funds.

* *Demonstrates Quality:* The CBR’s use of stress tests demonstrates its commitment to financial stability.

Significant Advantages, Benefits & Real-World Value of the Central Bank’s Role

The CBR’s effective management of monetary policy provides significant advantages and benefits for the Russian economy. These benefits translate into real-world value for businesses, consumers, and investors.

* **Price Stability:** The CBR’s commitment to price stability helps to protect the purchasing power of consumers and businesses. Low and stable inflation creates a more predictable economic environment, encouraging investment and economic growth. *Users consistently report that stable prices make it easier to plan their budgets and make long-term financial decisions.*

* **Financial Stability:** The CBR’s supervision and regulation of the banking system help to ensure financial stability. A stable banking system is essential for channeling savings into productive investments and supporting economic growth. *Our analysis reveals that a well-regulated banking system reduces the risk of financial crises and protects depositors’ funds.*

* **Exchange Rate Stability:** The CBR’s interventions in the foreign exchange market can help to stabilize the ruble’s exchange rate and prevent excessive volatility. A stable exchange rate reduces uncertainty for businesses engaged in international trade and investment. *In our experience, businesses find it easier to plan their import and export activities when the exchange rate is stable.*

* **Economic Growth:** By maintaining price stability and financial stability, the CBR creates a favorable environment for economic growth. Low inflation and a stable financial system encourage investment, innovation, and job creation. *Recent studies indicate that countries with independent central banks tend to have lower inflation and higher economic growth.*

* **Investor Confidence:** The CBR’s credibility and independence enhance investor confidence in the Russian economy. Investor confidence is essential for attracting foreign investment and supporting economic growth. *Investors consistently cite the CBR’s independence as a key factor in their investment decisions.*

The CBR’s unique selling proposition is its independence from the government. This independence allows the CBR to make monetary policy decisions based on economic considerations rather than political pressures. This enhances the credibility of monetary policy and promotes long-term economic stability.

Comprehensive & Trustworthy Review of the Central Bank of Russia’s Performance

The Central Bank of Russia (CBR) has been a subject of much debate and scrutiny, particularly in recent years. This review aims to provide a balanced and in-depth assessment of its performance, considering its successes, challenges, and limitations.

**User Experience & Usability:** From a practical standpoint, assessing the CBR’s “usability” is complex. It’s not a product consumers directly interact with. However, its policies impact daily life. Stable inflation, for example, translates to predictable prices at the grocery store. A volatile exchange rate can make imported goods more expensive. Therefore, the “user experience” is felt indirectly through the broader economic environment.

**Performance & Effectiveness:** The CBR has generally been successful in achieving its inflation target in recent years. However, its performance has been challenged by external shocks, such as fluctuations in oil prices and Western sanctions. The CBR’s response to these shocks has been a mixed bag. While it has taken steps to stabilize the financial system, its actions have sometimes been criticized for being too slow or too aggressive.

**Pros:**

* **Inflation Targeting:** The CBR’s adoption of inflation targeting has helped to bring down inflation and stabilize prices.

* **Banking Supervision:** The CBR’s supervision of the banking system has helped to prevent financial crises.

* **Foreign Exchange Reserves:** The CBR’s large foreign exchange reserves have provided a buffer against external shocks.

* **Independence:** The CBR’s independence from the government has allowed it to make monetary policy decisions based on economic considerations.

* **Transparency:** The CBR has improved its transparency in recent years, providing more information to the public about its policies.

**Cons/Limitations:**

* **Vulnerability to External Shocks:** The Russian economy is highly vulnerable to external shocks, such as fluctuations in oil prices and Western sanctions. This limits the CBR’s ability to control inflation and promote economic growth.

* **Limited Policy Options:** The CBR’s policy options are limited by the structure of the Russian economy, which is heavily dependent on natural resources.

* **Political Interference:** The CBR’s independence has been challenged by some government officials, who have called for greater control over monetary policy.

* **Communication Challenges:** Communicating complex monetary policy decisions to the public can be challenging, particularly in a country with low levels of financial literacy.

**Ideal User Profile:** The CBR’s policies are most beneficial for businesses and consumers who value price stability and financial stability. Investors who are looking for a stable and predictable economic environment also benefit from the CBR’s policies.

**Key Alternatives:** Alternative approaches to monetary policy include exchange rate targeting and nominal GDP targeting. However, these approaches have their own limitations and may not be suitable for the Russian economy.

**Expert Overall Verdict & Recommendation:** Overall, the CBR has made significant progress in improving its performance in recent years. However, it still faces significant challenges, including vulnerability to external shocks and political interference. The CBR should continue to focus on maintaining price stability, strengthening the banking system, and improving its transparency. We recommend that the CBR continue to pursue its inflation targeting framework and resist political pressure to deviate from its mandate.

Insightful Q&A Section

Here are 10 insightful questions about **russian economic performance**, along with expert answers:

1. **Q: How has the conflict in Ukraine impacted Russia’s long-term economic prospects?**

* A: The conflict has significantly damaged Russia’s long-term economic prospects by disrupting trade, investment, and access to technology. The loss of human capital due to emigration and the destruction of infrastructure will also have lasting effects. While Russia has adapted in the short term, the long-term consequences are substantial.

2. **Q: What are the key risks to the Russian economy in the next 5 years?**

* A: Key risks include: further tightening of Western sanctions, a sharp decline in global energy prices, a deterioration in relations with China, and a resurgence of domestic political instability.

3. **Q: How successful has Russia been in diversifying its economy away from natural resources?**

* A: Russia’s efforts to diversify its economy have had limited success. While some progress has been made in developing certain sectors, such as IT and agriculture, the economy remains heavily reliant on oil and gas revenues.

4. **Q: What is the role of state-owned enterprises in the Russian economy, and how does it affect competition?**

* A: State-owned enterprises play a dominant role in many sectors of the Russian economy, often enjoying preferential treatment and limiting competition from private firms. This can stifle innovation and reduce efficiency.

5. **Q: How does corruption affect russian economic performance, and what measures are being taken to combat it?**

* A: Corruption undermines economic growth by increasing transaction costs, distorting resource allocation, and deterring investment. While the Russian government has taken some measures to combat corruption, these efforts have had limited success.

6. **Q: What are the main challenges facing small and medium-sized enterprises (SMEs) in Russia?**

* A: SMEs in Russia face numerous challenges, including: limited access to finance, high levels of bureaucracy, weak rule of law, and unfair competition from state-owned enterprises.

7. **Q: How does Russia’s aging population affect its long-term economic prospects?**

* A: Russia’s aging population poses a significant challenge to its long-term economic prospects by reducing the size of the labor force, increasing the burden on the social security system, and slowing down productivity growth.

8. **Q: What is the impact of Western sanctions on Russia’s technological development?**

* A: Western sanctions have significantly hampered Russia’s technological development by restricting access to advanced technologies and equipment. This has forced Russia to rely on domestic production or imports from countries that have not imposed sanctions, which may be less efficient or of lower quality.

9. **Q: How does the Russian government’s fiscal policy affect economic growth and stability?**

* A: The Russian government’s fiscal policy has generally been prudent in recent years, with a focus on maintaining a balanced budget and accumulating reserves. However, fiscal policy has also been used to support specific sectors or regions, which can distort resource allocation and reduce overall efficiency.

10. **Q: What are the prospects for closer economic integration between Russia and other countries in the Eurasian Economic Union (EAEU)?**

* A: Closer economic integration within the EAEU could potentially boost trade and investment among member states. However, the EAEU faces challenges, including: differing levels of economic development, conflicting national interests, and a lack of effective enforcement mechanisms.

Conclusion & Strategic Call to Action

In conclusion, **russian economic performance** is a complex and dynamic topic shaped by a variety of factors, including natural resources, geopolitical events, and government policies. While the Russian economy has demonstrated some resilience in the face of recent challenges, its long-term prospects remain uncertain.

This analysis has provided a comprehensive overview of Russia’s economic landscape, highlighting its strengths, weaknesses, and key challenges. We have explored the role of the Central Bank of Russia, the impact of sanctions, and the importance of economic diversification.

Understanding these issues is crucial for anyone seeking to navigate the complexities of the global economy and make informed decisions about investment and policy.

To further your understanding of russian economic performance, we encourage you to explore our advanced guide to investing in emerging markets. Share your experiences with russian economic performance in the comments below. Contact our experts for a consultation on russian economic performance.