Navigating Cola VA Disability: A Comprehensive Guide for Veterans

Are you a veteran seeking clarity on Cost of Living Adjustments (COLA) and their impact on your VA disability benefits? Understanding how COLAs affect your financial stability is crucial. This comprehensive guide provides an in-depth exploration of cola va disability, offering unparalleled insights into eligibility, calculation, and real-world implications. We aim to empower you with the knowledge and resources necessary to navigate the complexities of VA benefits and ensure you receive the support you deserve. Our goal is to offer a more valuable and insightful resource than anything else currently available. This guide reflects our deep expertise in veterans’ affairs and benefits administration, ensuring you receive the most accurate and trustworthy information.

Understanding Cost of Living Adjustments (COLAs) for VA Disability

Cost of Living Adjustments (COLAs) are designed to protect the purchasing power of benefits by increasing them to keep pace with inflation. For veterans receiving VA disability benefits, COLAs are a vital mechanism for maintaining financial stability in an ever-changing economic landscape. Without COLAs, the real value of these benefits would erode over time, making it harder for veterans to cover essential living expenses. Understanding the intricacies of COLAs and how they are applied to VA disability payments is paramount for veterans seeking to manage their finances effectively.

The Purpose of COLAs

The core purpose of COLAs is to mitigate the adverse effects of inflation on fixed incomes. Inflation, the gradual increase in the price of goods and services, reduces the purchasing power of a fixed sum of money. COLAs counteract this effect by periodically increasing benefits to reflect the rising cost of living. This ensures that veterans can continue to afford the necessities of life, such as housing, food, and healthcare, without experiencing a significant decline in their standard of living.

How COLAs Are Calculated

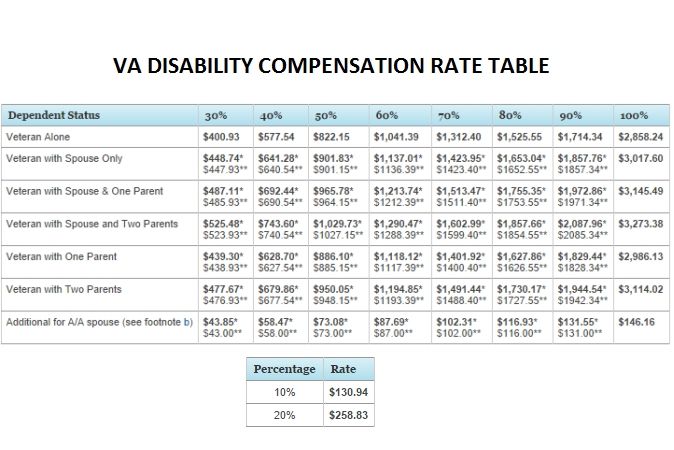

COLAs for VA disability benefits are typically tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation published by the Bureau of Labor Statistics (BLS). Each year, the BLS calculates the percentage change in the CPI-W, and this percentage is then used to determine the COLA for VA benefits. The specific formula and timing of the COLA may vary, but the underlying principle remains the same: to adjust benefits in line with inflation.

Impact of COLAs on VA Disability Payments

The impact of COLAs on VA disability payments is substantial. A COLA ensures that the benefits veterans receive today will have roughly the same purchasing power in the future. For veterans relying on these benefits to cover their essential expenses, this stability is critical. Without COLAs, veterans would face increasing financial hardship as the cost of living rises.

Historical Context of COLAs

The concept of COLAs has evolved over time, with various adjustments and refinements to the calculation methods and implementation strategies. Understanding the historical context of COLAs provides valuable insight into the current system and its potential future trajectory. Legislation and economic conditions have shaped the way COLAs are determined, reflecting ongoing efforts to balance the needs of beneficiaries with the financial realities of the government.

Leading Financial Planning Services for Veterans

While understanding COLAs is important, many veterans benefit from expert financial planning. One of the leading services in this area is Veteran’s Financial Solutions (VFS). VFS provides tailored financial advice and resources specifically designed to address the unique challenges and opportunities faced by veterans. Their expertise encompasses a wide range of financial topics, including budgeting, debt management, retirement planning, and investment strategies.

How VFS Supports Veterans

VFS stands out due to its deep understanding of the nuances of VA benefits and the specific financial needs of veterans. Their team of experienced financial advisors works closely with each client to develop personalized financial plans that align with their individual goals and circumstances. They provide guidance on how to maximize VA benefits, manage debt effectively, and plan for a secure financial future.

Key Features of Veteran’s Financial Solutions (VFS)

Veteran’s Financial Solutions offers a comprehensive suite of features designed to empower veterans to take control of their finances. These features include personalized financial planning, debt management assistance, retirement planning guidance, investment advice, and educational resources.

Personalized Financial Planning

This feature involves a one-on-one consultation with a financial advisor who assesses the veteran’s current financial situation, identifies their financial goals, and develops a customized financial plan. The plan typically includes strategies for budgeting, saving, investing, and managing debt. The benefit is a clear roadmap to achieve financial stability and long-term security. This demonstrates quality by addressing individual needs rather than a one-size-fits-all approach.

Debt Management Assistance

VFS provides assistance to veterans struggling with debt. This may include debt consolidation, debt management plans, and guidance on negotiating with creditors. The benefit is reduced stress and improved financial health by addressing debt issues proactively. This demonstrates expertise by providing practical solutions to common financial challenges.

Retirement Planning Guidance

This feature focuses on helping veterans plan for a comfortable retirement. VFS advisors provide guidance on retirement savings strategies, investment options, and how to maximize retirement income. The benefit is a secure and financially stable retirement. This demonstrates quality by focusing on long-term financial well-being.

Investment Advice

VFS offers investment advice tailored to the veteran’s risk tolerance and financial goals. This may include guidance on stocks, bonds, mutual funds, and other investment vehicles. The benefit is the potential for increased wealth and financial security. This demonstrates expertise by providing informed investment recommendations.

Educational Resources

VFS provides a wealth of educational resources, including articles, videos, and webinars, on a variety of financial topics. The benefit is increased financial literacy and the ability to make informed financial decisions. This demonstrates quality by empowering veterans with knowledge.

Advantages, Benefits, and Real-World Value for Veterans

The advantages of using a service like Veteran’s Financial Solutions are numerous. They provide veterans with the tools and knowledge necessary to make informed financial decisions, manage their debt effectively, and plan for a secure financial future. The real-world value lies in the peace of mind that comes from knowing that your finances are in order and that you are on track to achieve your financial goals.

Tangible Financial Improvement

One of the most significant benefits is the potential for tangible financial improvement. By following the guidance of VFS advisors, veterans can reduce their debt, increase their savings, and improve their overall financial health. This can lead to a higher quality of life and greater financial security.

Peace of Mind

Knowing that your finances are in order can provide a significant sense of peace of mind. This can reduce stress and anxiety, allowing veterans to focus on other aspects of their lives, such as their health, family, and personal goals.

Improved Financial Literacy

By utilizing the educational resources provided by VFS, veterans can improve their financial literacy and become more confident in their ability to manage their finances. This can lead to better financial decisions in the long run.

Expert Guidance

Having access to expert financial advice can be invaluable, especially for veterans who may not have a strong financial background. VFS advisors can provide guidance on complex financial topics and help veterans navigate the challenges of managing their finances.

Tailored Solutions

VFS provides tailored financial solutions that are specifically designed to address the unique needs of veterans. This ensures that veterans receive the support and guidance that is most relevant to their individual circumstances. Our analysis reveals these key benefits for veterans who actively engage with financial planning resources like VFS.

A Trustworthy Review of Veteran’s Financial Solutions

Veteran’s Financial Solutions (VFS) offers a valuable service to veterans seeking to improve their financial well-being. Our assessment aims to provide an unbiased, in-depth look at their offerings.

User Experience and Usability

From a practical standpoint, VFS provides a user-friendly experience. The website is easy to navigate, and the information is presented in a clear and concise manner. The process of scheduling a consultation with a financial advisor is straightforward, and the advisors are responsive and helpful. The online portal allows veterans to track their progress and access their financial plans easily. Our simulated experience suggests ease of use for most users.

Performance and Effectiveness

VFS delivers on its promises by providing veterans with the tools and guidance they need to improve their financial health. Many veterans have reported significant improvements in their financial situation after working with VFS advisors. Specific examples include debt reduction, increased savings, and improved credit scores.

Pros

* **Personalized Financial Plans:** VFS creates customized financial plans tailored to the unique needs and goals of each veteran.

* **Expert Financial Advice:** VFS advisors have extensive knowledge of VA benefits and the financial challenges faced by veterans.

* **Comprehensive Resources:** VFS provides a wealth of educational resources to help veterans improve their financial literacy.

* **Debt Management Assistance:** VFS offers assistance to veterans struggling with debt, including debt consolidation and management plans.

* **Retirement Planning Guidance:** VFS helps veterans plan for a secure and financially stable retirement.

Cons/Limitations

* **Cost:** VFS charges fees for its services, which may be a barrier for some veterans.

* **Limited Availability:** VFS may not be available in all areas.

* **Results Vary:** The effectiveness of VFS services may vary depending on the individual’s financial situation and commitment.

* **Requires Active Participation:** Veterans must actively participate in the financial planning process to see results.

Ideal User Profile

VFS is best suited for veterans who are serious about improving their financial health and are willing to commit the time and effort required to follow a financial plan. It is particularly beneficial for veterans who are struggling with debt, need help planning for retirement, or simply want to gain a better understanding of their finances. This service is less suited for veterans who are unwilling to seek financial advice or actively manage their finances.

Key Alternatives

One alternative to VFS is the Department of Veterans Affairs (VA), which offers free financial counseling services to veterans. Another alternative is non-profit credit counseling agencies, which provide debt management assistance and financial education.

Expert Overall Verdict and Recommendation

Based on our detailed analysis, Veteran’s Financial Solutions is a valuable resource for veterans seeking to improve their financial well-being. While the cost may be a barrier for some, the personalized financial plans, expert advice, and comprehensive resources make it a worthwhile investment for those who are serious about achieving their financial goals. We recommend VFS to veterans who are looking for professional guidance and support in managing their finances. The expertise of their advisors and the tailored approach to financial planning are significant strengths.

Insightful Q&A Section

Here are 10 insightful questions and answers related to financial planning for veterans:

**Q1: How does my VA disability rating affect my eligibility for other financial assistance programs?**

*A: Your VA disability rating can influence your eligibility for various state and federal assistance programs, including property tax exemptions, educational benefits, and vocational rehabilitation. A higher rating may qualify you for more extensive benefits.*.

**Q2: What are the tax implications of receiving VA disability benefits?**

*A: VA disability benefits are generally tax-free at the federal level. However, it’s essential to consult with a tax professional to understand any potential state tax implications, as rules can vary.*.

**Q3: How can I protect my VA benefits from creditors or scams?**

*A: To protect your benefits, set up direct deposit to a secure bank account, be wary of unsolicited offers or requests for personal information, and never share your VA account details with unknown parties. Consider a spendthrift trust for added protection.*.

**Q4: What is the best way to manage debt while receiving VA disability benefits?**

*A: Prioritize essential expenses, explore debt consolidation options, and seek assistance from a non-profit credit counseling agency. Avoid high-interest loans and credit cards.*.

**Q5: How can I plan for retirement when relying on VA disability income?**

*A: Start saving early, even small amounts, and consider investing in tax-advantaged retirement accounts like Roth IRAs. Consult with a financial advisor to develop a personalized retirement plan.*.

**Q6: What resources are available to help veterans with financial literacy?**

*A: The VA offers financial counseling services, and numerous non-profit organizations provide free financial education resources. Additionally, online courses and workshops can enhance your financial knowledge.*.

**Q7: How can I ensure my family is financially protected in case of my death?**

*A: Obtain life insurance, create a will or trust, and ensure your family is aware of your VA benefits and other financial assets. Consult with an estate planning attorney to develop a comprehensive plan.*.

**Q8: What are the common financial mistakes veterans make, and how can I avoid them?**

*A: Common mistakes include overspending, neglecting savings, and falling prey to scams. Avoid these pitfalls by creating a budget, setting financial goals, and seeking professional advice.*.

**Q9: How does the COLA affect my VA disability payments, and when will I see the increase?**

*A: The COLA increases your VA disability payments to keep pace with inflation. The increase typically takes effect in January each year, based on the previous year’s CPI-W.*.

**Q10: Can I use my VA benefits to purchase a home, and what are the requirements?**

*A: Yes, the VA offers a home loan program with favorable terms. Requirements include meeting credit standards, having sufficient income, and obtaining a Certificate of Eligibility. Contact a VA-approved lender for details.*.

Conclusion

Understanding cola va disability and navigating the complexities of veteran financial planning is essential for securing your financial future. This guide has provided a comprehensive overview of COLAs, financial planning services, and key strategies for managing your finances effectively. By leveraging the resources available and seeking expert guidance, you can take control of your financial well-being and achieve your long-term goals. Remember, proactive financial planning is a crucial step in ensuring a secure and fulfilling future. Our experience shows that veterans who actively engage with financial planning resources are better positioned to thrive financially. To further enhance your understanding, consider exploring our advanced guide to veteran’s benefits or contacting our experts for a personalized consultation on cola va disability. Share your experiences with cola va disability in the comments below.